Following the recent sad development in Ukraine, Netflix reportedly will be forced to broadcast Putin propaganda, as reported from the Politico website. Will it follow other services that stopped servicing Russia as a sign of protest, or will it stick to the new deal? With this premise, let’s continue the “company review” series that started with GameStop.

An Overview

For the ones who lived on Mars in the last 15 years, Netflix is an American subscription streaming service and production company.

It was launched on August 29, 1997, by Reed Hastings and Marc Randolph. It started as a DVD rental service. The founders thought that VHS were too expensive to stock and deliver and decided to enter the home video industry as soon as DVDs were born.

It shifted to streaming service as we knew it in January 2007. In 2009, Netflix streams overtook DVD shipments.

Studied in innovation books for the “murder” of Blockbuster: while Netflix understood the trend shift and managed to remodel its business proposition, the blue VHS maker gave for granted its position of dominance and did not recognise that the market was about to be disrupted.

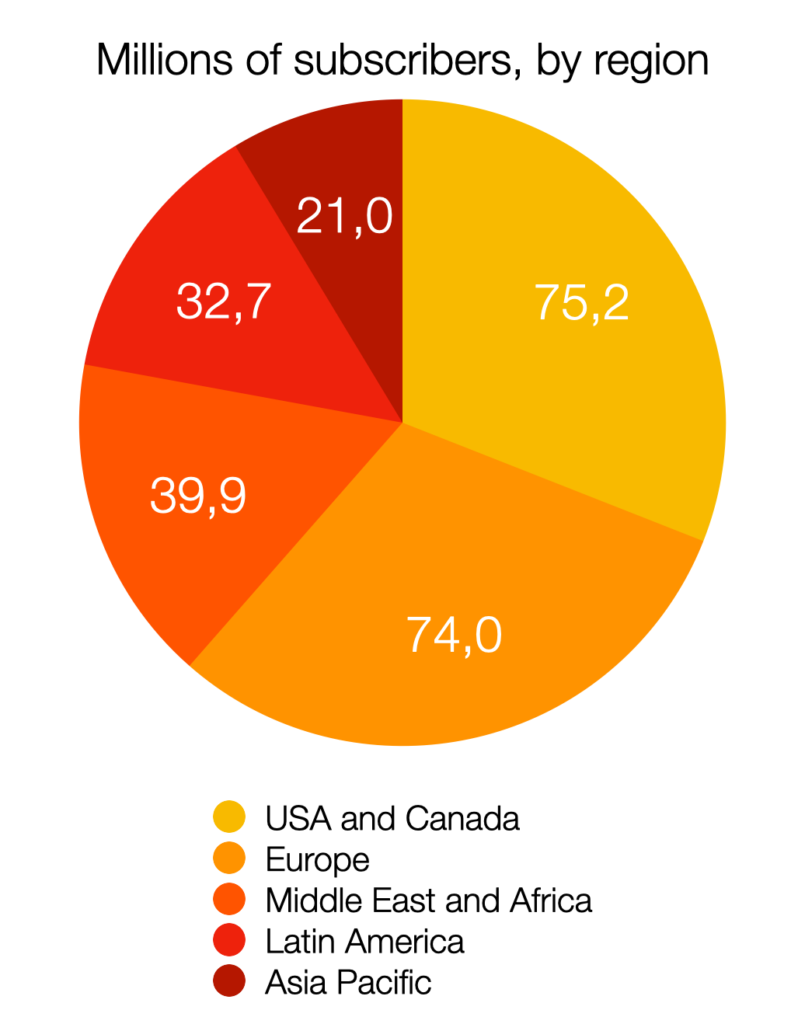

It is currently 115th on the Fortune 500 chart. It is the largest entertainment/media company by market capitalisation: it has over 222 million subscribers worldwide, distributed as shown in the image.

There are approximately 11,300 full-time employees located globally in 60 countries. Of these, 8,600 (76%) are in the United States and Canada, 1,400 (12%) in Europe, the Middle East, and Africa, 400 (4%) in Latin America and 900 (8%) in Asia-Pacific.

It started the production of original content ten years ago: Lilyhammer (2012) and Beasts of No Nation (2015) have been the first original series and movies. Nowadays, original productions are the most valuable asset for the company.

Value Proposition

What is Netflix trying to provide to the customer?

Summing up brand proposition in one sentence, Netflix wants to provide quality entertainment to its users 24/7, which means:

- Access to a massive catalogue of products, with content for all tastes.

- On-demand streaming, with 24/7 access – without ads.

- Possibility of binge-watching.

- Offering personalised lists and recommendations based on the content watched.

- Original and high-definition content.

- User accounts allow each person in the family to have a personalised profile.

- All of this is on any device connected to the internet.

Financial Figures

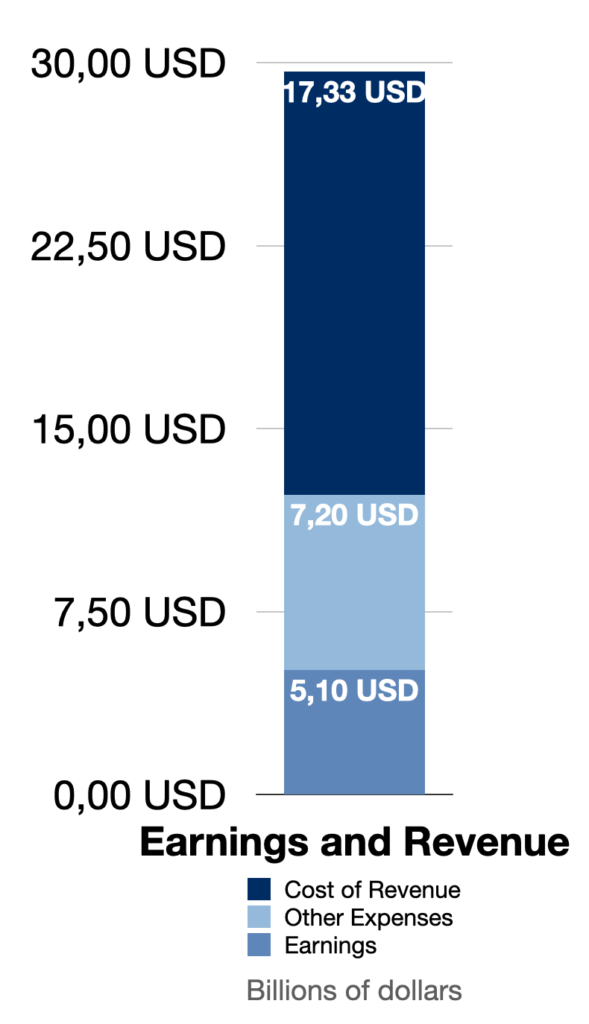

- PE (35.8), PEG (2.2) and PB (11.6) are three ratios that look poor compared to the sector.

- The company is projected to grow earnings by 16.6% per year and revenue by 10.7% per year.

- Excellent past performance in the last five years: earnings have grown by 49.1% per year (compared to 23.3% of the growth of the sector and 13.6% of the market)

- ROE (32.3%), ROA (13,2%) and ROCE (17.2%) are considered reasonable compared to the market.

- Short term assets ($8.18 billion) can’t cover either short terms ($8.5 billion) or long term liabilities ($20.2 billion).

- Equity debt is high but decreasing (from 124.7% to 97.1% over the past years).

- Operating cash flow does not cover the debt, but EBIT can cover interest payment.

The company looks healthy overall.

Competition

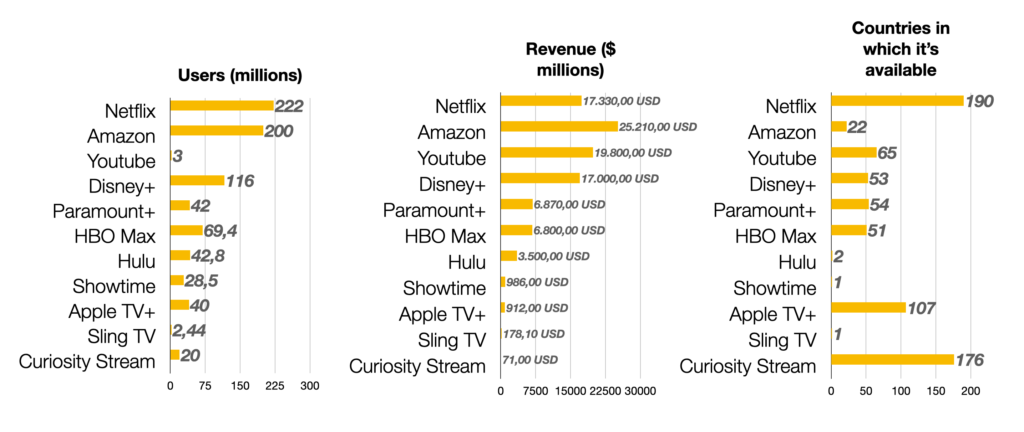

Though it seems more crowded than ever, the market here are the ten most noticeable competitors by users, revenue, and countries.

Netflix still holds the crown overall, but other services like Disney+ and Prime Video are getting closer quite noticeably.

While competition usually generates positive externalities for the consumer, for instance, can benefit from price competition, this time, the more streaming services are out, the harder it can be to find the content you want to see in the service you’ve already seen subscribed.

SWOT Analysis

Strengths

Firstly, Netflix can currently rely on the following weapons:

- Its brand is solid and recognised.

- It is present in almost every country in the world.

- Pricing is strategical and affordable for many.

- The original contents of the series and movie are vast and high quality: the Academy has recognised 15 Oscars in eleven categories from 116 nominations in twenty-four categories. On the Emmy side, Netflix has won 112 from 619 nominations.

- Content tailoring: no user sees the same things on the home page. Netflix is recognised for the high amount of personalised suggestions I can give to the audience using Machine Learning algorithms. Its A/B Testing culture is widely known.

- Proven adaptability: we have seen how the giant exploited trends in the DVD vs streaming phase.

Weaknesses

Netflix has these “flaws” that have to manage:

- Debt is increasing.

- Not every country produces original content everywhere. Some cultures struggle to relate because there’s no local Netflix original.

- Account sharing is a phenomenon that cuts potential revenue.

- North America polarises Netflix customer base.

- COVID-19 has reportedly inflated the costs of production of series that needs to follow high sanitary protocols.

- Producing content employs a significant volume of cahs, and its return is not always immediate. The activity is capital intensive.

Opportunities

For sure, Netflix can capitalise on the following global trends:

- It recently launched Netflix Games. Videogames is a field with a lot of potential for diversifying the business.

- Internet-based services are increasing everywhere, especially after the pandemic, Netflix can continue to surf this wave.

- TV-series brands and connect with local customer base: country-based original content can have a significant PR effect, as with Squid Game.

Threats

Lastly, the company should take the following events that may have adverse effects under the radar.

- COVID-19 restrictions for production could increase.

- Competition is increasing, as seen before.

- More competition means more companies bidding for rights of non-original content, which may increase cost volumes.

- Piracy has always been a video entertainment enemy.

- Since itìs a multinational service, you need to face an environment of evolving government restrictions, regulations and taxation. For instance, in China, the government forbids the platform’s use.

- Seasonality: Netflix peaks revenue in Q4, and it’s highly dependent on the Christmas season.

- Being an online service, Netflix is dependent on technological partners, such as Amazon Web Services, which is also a competitor in streaming services.

Summing up

What will happen in the future for Netflix is unknown, but for sure, Netflix will stay as one of the big tech giants of this age.

Main source: Netflix Financial Statement https://ir.netflix.net/financials/financial-statements/default.aspx

Leave a Reply