Why bother?

Many people can agree that saving and investing are complex topics. No one explains why or how you should do any of the two when life is so beautiful once you understand how to trade money for cocktails, massages and expensive dinners.

That is especially worrying when considering that, according to a recent study by the National Financial Educators Council (NFEC) found that 28.8% of Americans aged 65 or older said their lack of knowledge about personal finances caused them to lose $30,000 or more in their lifetimes. And you may think, “hey, but I am good with finance knowledge, I won’t be part of this group!” You could be wrong: every few years, the Financial Industry Regulatory Authority (FINRA) issues a five-question test as part of its National Financial Capability Study, which measures consumers’ knowledge about interest, compounding, inflation, diversification, and bond prices. On its most recent test, only 34% of those who took the quiz got four out of five questions correct, which suggests that the fundamental economic and financial principles that underpin these problems are widespread.

At this point, you may feel safe thinking that the money you saved every month makes you a diligent investor, but unfortunately, there are two things to consider that makes the just saving strategy a bit dull:

- Inflation: every year, the prices rise at an average rate of 2%, which means that your savings are 2% less valuable every year since the number of goods you can buy with a specific sum decreases. Imagine putting aside 40.000€ under the roots of the tree of the garden to guarantee you a quiet retirement, unburying them in 40 years and finding out 21.884€ are gone. Not a good feeling, isn’t it?

- The opportunity cost of not investing: economists like to talk about opportunity cost, which is the potential benefits an individual, investor, or business misses out on when choosing one alternative over another. For example, when facing the university and working, you are not considering only university fees but also the “cost” of the salary you will not receive if you do not work. A bit counterintuitive, but it makes sense. Well, if you invested those 40.000€ in S&P 500 stock 40 years ago, today you would be a millionaire (or almost, if you consider inflation). Better than losing 21.884€.

Investing 101

Many people can be frightened by investing, the stock market, interest rates, et cetera. Indeed, it is natural to feel not competent about many words used in financial tv news, but the good news is that you do not need a PhD in finance to start investing. Still, a little introduction could be helpful to: in general, investing in a company means buying a piece of a company (a stock) to have a tiny percentage of ownership. In general, if the company you invested in grows and achieves its financial results, the value of the stock increases and once sold, there will be a profit. The stocks are generally traded on stock markets, to which you can access using many different platforms, such as eToro, RobinHood, et cetera.

In my opinion, there are three ingredients for a suitable investment strategy.

- Diversification: high risks, high returns, isn’t it? Also, in the stock market, stocks are riskier (in the sense that they present a more increased value variability). For example, you can hear many startups jump from 0 to 1 billion $ evaluations in few months, but it’s not the same for governments and nation-states. That’s the reason why governance bonds (national stocks) are considered low-return-low-risk investment, while startups are the opposite (actually, they’re not even traded on traditional stock markets). Does high-returns-low-risks investment exist? The answer would be kind of: when you start investing in many different companies, you can decrease the risk with a bit of compromise of the returns. If you’re interested in the topic, I suggest you read more about Markowitz’s work.

- Long term vision: in April 2020, an Italian Index Fund, a mix of Italian stock, lost 30% of its value. How would you have felt to lose 30% of your savings? I guess terrible.But guess what: economy on one side is very cyclic, but on the other one it has a natural tendency to grow in the long term, so when investing, it is fundamental to watch and wait patiently, because, despite the daily low, the trend should be increasing. Connected to that, a reasonable investment strategy will be about investing monthly to protect yourself from fluctuation. While in good months you will be able to celebrate the returns, you will be able to buy stocks at lower prices in bad months, with a higher chance of giving good returns in the future.

- Compound interest: according to Einstein, compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pay it. The idea is that returns of an investment are not linear but exponential. Their growth rate tends to increase indefinitely. For instance, let’s pretend that you receive some money every day, starting from a cent and that every day it doubles. How many months or years would you need to become a millionaire? 26 days. Pretty counter-intuitive. Applying the same logic on stock investment, if you invest 10.000€ in a stock with a 10% yearly rate of return, in 40 years, you will multiply the initial sum by a factor of 45.But why? How does it work? The principle here is that every year you can interest so that the basis on which you calculate the 10% grows every year. For example, in year 1, it is 10% of 10.000€ (1.000€), but in year 2, since you earned 1.000€ on day one, it is 10% of 11.000€ (1.100€). There’s already an extra 100€ from the year before. And how about day 20? You have reached a threshold of 67k €, so the 10% return will amount to 6.700€, which is 5.700€ more than the gain in year 1.Morale here is to be thoughtful of this principle and wait for the best results to come in the final years of the investment.

How to start

I like a minimalist approach on basically any part of life, and also here. I intend to propose a way that, once established, is entirely automated and does not require any intervention or check (unless you’re curious to know). I manage my investing is Moneyfarm, an online service that lets you create a portfolio of stocks and funds based on your own needs and automate any aspect of its management, checking the three ingredients mentioned above. In particular, the things I like about it are:

- Low fee costs: it’s one of the available few Robo-advisor in Italy, which means that AI and algorithms manage the portfolio instead of financial consultants. As a consequence, fees can be kept way lower than most of the competitors. Do you know that a minimal fee could cost you hundreds of thousands of euros?

- Automatic: as mentioned before, you can set up an automatic payment plan so that you don’t have to worry every month. The platform will also react automatically to the performance of the stocks and the market by selling and buying automatically.

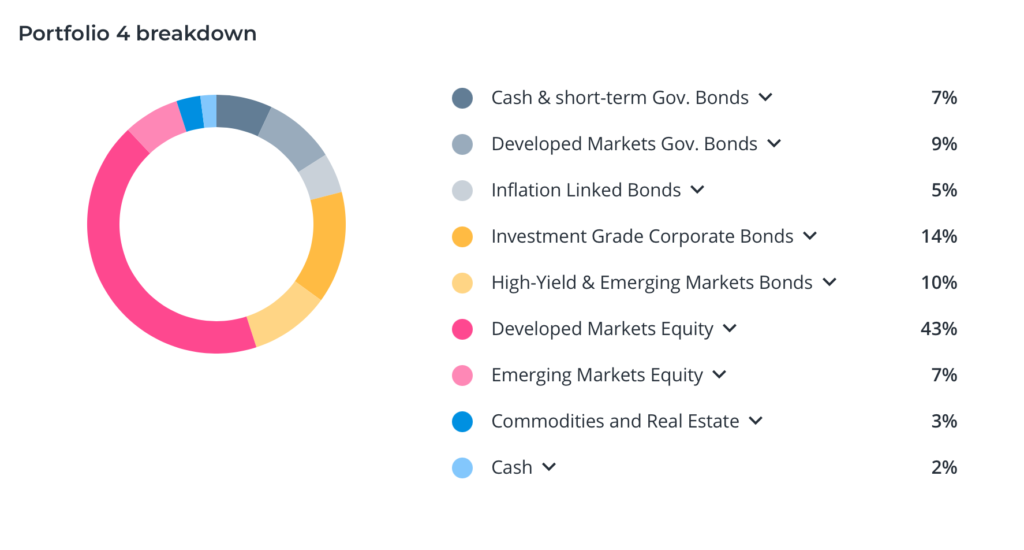

- Good diversification: all the portfolios proposed are well balanced, and they guarantee you to bet on many different horses, lowering the risks while keeping. For example, here’s an example of a portfolio.

I want to be precise that the service does not pay me, but I am just sharing a positive experience, so feel free to make your evaluation!

And you? What do you do for investing and saving?

Important Disclaimer The information contained on this blogpost and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice, but just for educational use. I am not an attorney, accountant or financial advisor, nor am I holding myself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. Nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial professional to address your particular information.

Leave a Reply