The Black Swan Theory

Could the covid 19 pandemic be forseen? Were we blind in not preparing enough for what happened in 2020? The Black Swan Theory could help us understand it.

It’s been a while since the last time I read a book that proposed “revolutionary” ways of thinking like “The Black Swan: The Impact of the Highly Improbable“.

In a few words, the author proposes that all the efforts that sociology, scientist and economist put into forecasting the future based on the past are useless. Our reality is shaped by catastrophic and unforeseeable events called “Black Swans”.

The term comes from a legend telling that ancient populations did not believe in black swans until they saw one of them. Nassim Nicholas Taleb defines black swans events with three key characteristics:

- The event observed comes as a huge surprise. Classic statistics would describe it as a vast and improbable event.

- The event’s happening provokes enormous consequences and changes, and a small amount of them explain many facts happening in the world.

- Due to psychological biases, humans tend to find an explanation afterwards and point the finger against whoever did not recognise it as unavoidable.

The last black swans have been the Covid19 pandemic, the spread of the internet and the 2008 economic crisis, which have been arguably unforeseen and revolutionary.

Why do the Black Swan Exists?

Another concept introduced by Taleb is the juxtaposition between Mediocristan and Extrimistan, and he uses career as an example. In the first one, you are a dentist, a consultant or a doctor. There is a limit on the variability of your earnings:

- The amount of time you can put in defines the salary.

- Your effort is the first predictor.

- No single day will have a significant impact on your income.

In the latter world, your effort is always the same. You can earn 0€ or be Jeff Bezos. You can be an unknown writer and live paycheck by paycheck or be J.K. Rowling. The amount of books written is similar, but the output is way different.

Taleb wants to suggest that we live in Extrimistan, but we still believe in living in Mediocristan.

How Brains Hides the Black Swan

Why do human brains allow us to be so stuck in Mediocristan? Minds go through several biases to cope with reality more easily. Behavioural psychologists have observed that the grey matter tend to use “shortcuts” to cope with the complexity of reality that may drive sub-optimal decisions.

In this case, three “biases” hide black sways to our eyes:

- The illusion of understanding: the world is too complicated, and people wrongly oversimplify events

- The retrospective distortion: we create stories and connect dots to make sense of the world, even if when there’s not

- The categorisation tendency: we love creating boxes in which we put everything that looks resemble.

- The round-trip fallacy: we are very likely to confuse the statement “no evidence of black swan” with “evidence of no black swan”. Taleb uses the example of a turkey that since has not been eaten for 1000 days. He will never be at the center of the table during a Thanksgiving.

- The survivorship bias is a sample selection bias that occurs when a data set only considers “surviving” or existing observations. It fails to consider observations that have already ceased to exist. Do become-rich-books survey people who were unable to succeed? In finance, an example of survivorship bias is when studies on mutual fund return only use databases containing data about mutual funds that currently exist and fail to include data about funds that no longer exist.

A Note on Statistics

As an economics alumnus, the book was very “involving”. The author throws away 99% of business and financial models created to make sense of the world. Mediocrity is just an illusion.

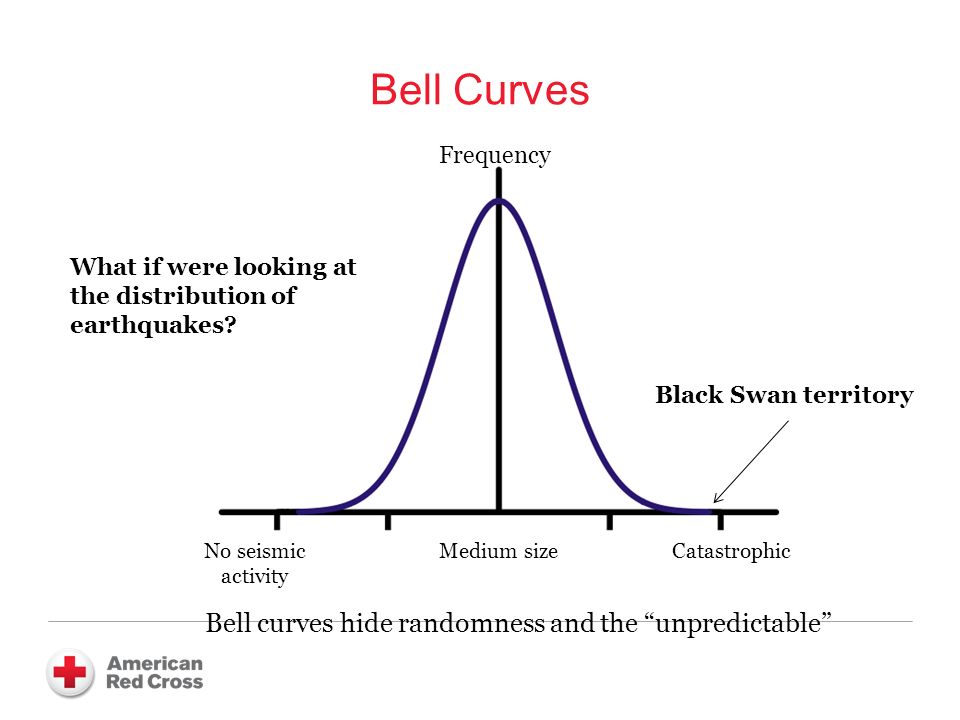

Bell curves that assume that everything regresses to the mean are just a consequence of the survivorship bias: they are waiting for some proof to disprove definitively. Or better, to focus on the end of the tail.

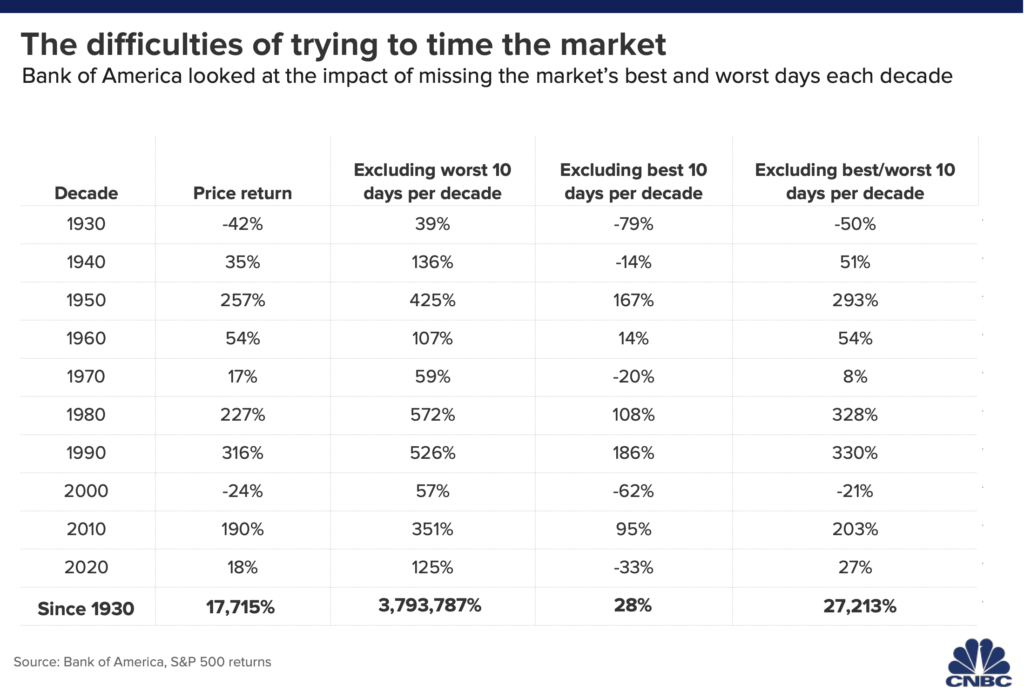

For instance, this especially for financial markets: stocks are harder to predict than you think: According to CNBC and Bank of America, “Looking at data going back to 1930, the firm found that if an investor missed the S&P 500′s 10 best days each decade, the total return would stand at 28%. If, on the other hand, the investor held steady through the ups and downs, the return would have been 17,715%.”

Now What?

You may now feel on a troubling floor and wonder how to cope with such an uncertain world. At the end of the book, the author suggests being extremely aggressive on your bets when there can be a positive black swan and being conservative when there can be a bad one.

It can hold for career paths, strategic decisions and financial investment. Work on a side-hustle while building the corporate ladder, experiment in serendipity while evolving your cash cow products and mix a safe index fund strategy with a bit of gambling.

Leave a Reply